by Francisco Durán Herrera

Perhaps you have heard or read about Antonio Laureano, the young Portuguese who in October 2020 in Praia do Norte – Nazaré, Portugal – surfed the highest wave ever recorded, with a height of 30.9 meters. Just like on that day, when Laureano began surfing this colossal wave from the bottom, central banks all around the world were facing the wave of inflation that currently hits the world economy, always with the idea of, same as the Portuguese surfer, keep control avoiding to fall into the deep, chaotic and dark sea that a global crisis implies.

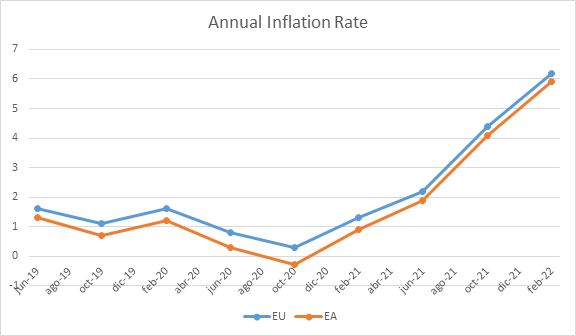

There is no doubt that the entire world is suffering from a wave of inflation. The United States reached an annual inflation rate of 8.5% in February, the highest since January 1982, exactly as the market expected. In Europe, the situation is following the same path; on one hand, there is the Euro area – currently composed of 17 countries- whose annual inflation rate was up to 7.5% in March and, on the other hand, the European Union Member States reached a 6.2% in February, both figures taken from Eurostat.

A mixed combination of the pandemic crisis, the war in Eastern Europe and the related energy crisis means that financial-economic stability, prices and wages are under pressure, particularly in Europe.

In this post, I will try to explain the role of the European Central Bank (ECB) – the autonomous institution with the monopoly on the use of all monetary policy in the Eurozone – in stabilising inflation. In addition, we will analyse the future challenges that the institution faces in this conflictive scenario.

I must mention that this article will delve into the situation of the countries that make up the Eurozone and not those that are part of the EU. It will allow us to focus on an even more homogeneous group of countries to better understand their multiple vicissitudes.

At the beginning of the wave

First of all, to understand the current scenario, it is important to analyse the figures that existed before and during the pandemic, and those which came as a result of the conflict between Ukraine and Russia.

The first outbreak of Coronavirus (COVID-19) in Europe was registered on January 25th 2020. The inflation rate back then was 0.8% in the European Union. Since the financial crisis of 2008 in the United States and the sovereign debt crisis in Europe (2010), the ECB has dealt with a deflation phenomenon, reaching levels even under the ECB target of 2%. The pandemic shock affected both the demand and the supply, reducing consumption, investments, and increasing unemployment rates despite the restrictions on the termination of labour contracts imposed by some countries like Italy, for instance. As a consequence, the economy started to freeze, causing the inflation rate to fall dramatically, almost to 0%. In January 2021, as a result of easing the sanitary restrictions, return of supply chains, incentives to the economy and expansive monetary policy, the economy started to recover little by little.

Choosing the best Surfboard

Today the situation is extreme. The ECB is facing war and dealing with an overheated economy. Just as Antonio Laureano chose his best surfboard for that epic day in Praia do Norte, the ECB must choose its best monetary policy instruments to face this crisis.

Regarding the content of these instruments, there does not seem to be much clarity but, undoubtedly, the ECB has not set limits. In words of Christine Lagarde, President of the ECB at an event organised by the Central Bank of Cyprus on March 30th: ”For our part, the ECB has made it clear that, in the context of the ongoing conflict, we will take whatever action is needed to pursue price stability and safeguard financial stability”.

Statements like this remind me of the comforting “whatever it takes” by Mario Draghi (ECB’s President between 2011-2019) in July 2012, who during a global economic crisis, ensured financial stability and the permanence of the euro as the official currency.

Both leaders, keeping in mind the absolute powers of the ECB, have used different tones in the forward guidance of monetary policy. Although the message is similar, Draghi’s policy was outlined with an accommodative direction while Lagarde’s speech has a more threatening tone. Logically, the context of each of these periods influenced the narrative of the discourse.

Maybe one of the few certainties, and not free of some controversy, is the progressive pullback of the monetary incentives created to face the pandemic, with the illusion of decompressing the economy.

Swimming against the current

As if the ECB was swimming against the current, the European institution decided not to raise or modify the interest rates, as confirmed on April 14th. This controversial decision calls into question the conduct of monetary policy since, according to traditional economists, high levels of inflation are due to an excess of money supply.

An increase in the interest rate would cause a contraction on the economy, therefore, an eventual decrease in the monetary demand and the respective offer, but this would only be a repetition of a traditional scheme that is not applicable. A rise in the interest rate would imply accentuating the problems of an economic contraction, increased unemployment and shortages of products and supplies.

The ECB’s bet is not to deepen the financial problems of the various economic agents, by maintaining investment and public spending. The inflationary pressure comes from the contraction of production as a consequence of the developing conflict; “Russia’s aggression in Ukraine is causing enormous suffering. It is also affecting the economy in Europe and beyond. The conflict and its inherent uncertainty are weighing heavily on the confidence of businesses and consumers. Trade disruptions are leading to new shortages of materials and inputs. Arising prices of energy and commodities are reducing demand and holding back production”, says a statement from the institution.

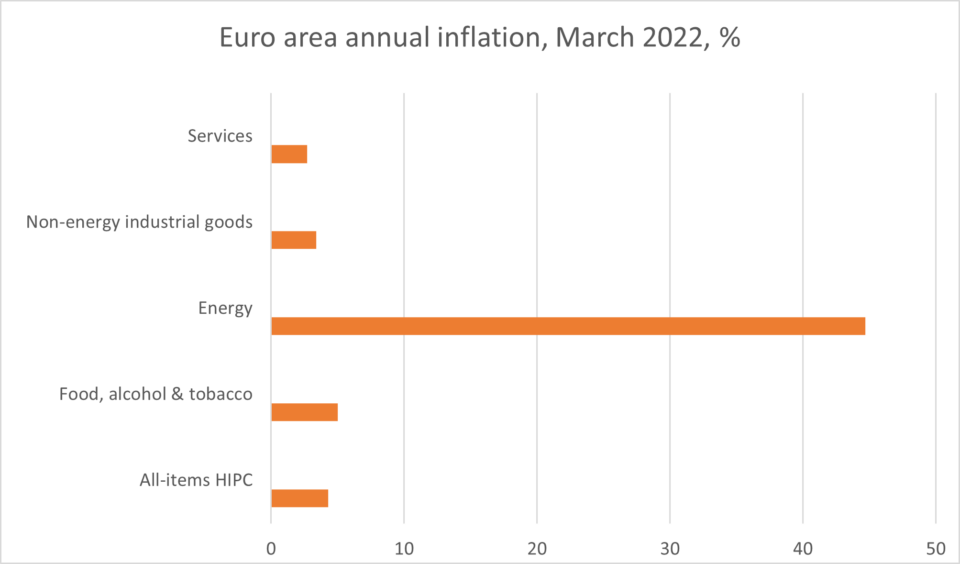

It is worth considering that the conflict and the sanctions against Russia have caused a rise in the prices of oil, gas, basic food, fertilizers and other inputs. This nation is the supplier of at least 40% of the European Union’s energy consumption. On the one hand, Ukraine is known as the granary of Europe due to the fertility and extension of its lands in the production of sunflower, barley and corn. The pressure on the price index operates from various fronts. The energy price registered an annual growth of 44.7% in the Eurozone in March which affects the general prices index, and the scarcity of cereals directly affects the food and livestock industry.

The FED looks for another spot

The ECB has distanced itself from the monetary policy of the US Federal Reserve, which has systematically increased its interest rate. The case of the American economy is diverse, the Biden administration is less exposed than the EU in geopolitical terms, but its economic decisions are not without controversy.

Growing economies may be strongly affected due to heavy external indebtedness, which has already increased during the pandemic. The increase in interest rates could cause problems of inability to pay the external debt. In addition, the FED, unlike the ECB, is in the constant dilemma of facing two macroeconomic objectives: full employment and low inflation.

How big will this Wave be?

Uncertainty is the term most heard in economist circles and even in the ECB. The dynamics of the war have strongly influenced the prices of raw materials and, therefore, it is difficult to determine how big this wave of inflation will be.

Following a cautious policy, the ECB decided to postpone any adjustment of the Key Interest Rates and, in addition, indicated that any movement will take place once the Governing Council’s net purchases under the APP have finished.

The great challenge of monetary policy will be to reconcile a new trilemma, where the stabilization of inflation is at one point, the application of sanctions on the Putin government at the other, and the economic consequences of the pandemic at last.

The way to achieve a simultaneous solution or at least one in return is the flexibilisation of monetary policy. The current situation does not allow us to give a concrete and definitive answer because new facts that change the course of the world economy appear with unprecedented speed.

A monetary policy tailored to the data seems to be the way out of this crisis. The ECB must generate trust with its statements and make everyone believe in “whatever it takes” again.