by Klara Tercic

Analysing and understanding the impact that unprecedent events – like the covid outbreak and the unprovoked attack of the Russian army on Ukraine – have on the European economy, is not an easy task. Certainly, sudden supply shocks are expected to hit the European market and possibly jeopardize the production of certain products. Disruptions in supply chains for critical raw materials (CRMs) represent a real threat for Next Generation EU and its plan “to make Europe greener, more digital and more resilient”. Nevertheless, why are raw materials so important for the EU? Who supplies CRMs for the European economy, and which is the action plan proposed by the European Commission?

The “critical” nature of critical raw materials

Throughout the past decades, raw materials have become an essential component of the European economy. First, their importance is linked directly to industries across all supply chain stages. Second, both applications used in everyday life and modern technologies, rely heavily on rare materials. Finally, raw materials are indispensable for producing new, modern, and carbon-neutral solutions, like wind turbines, batteries for electric vehicles, and solar panels.

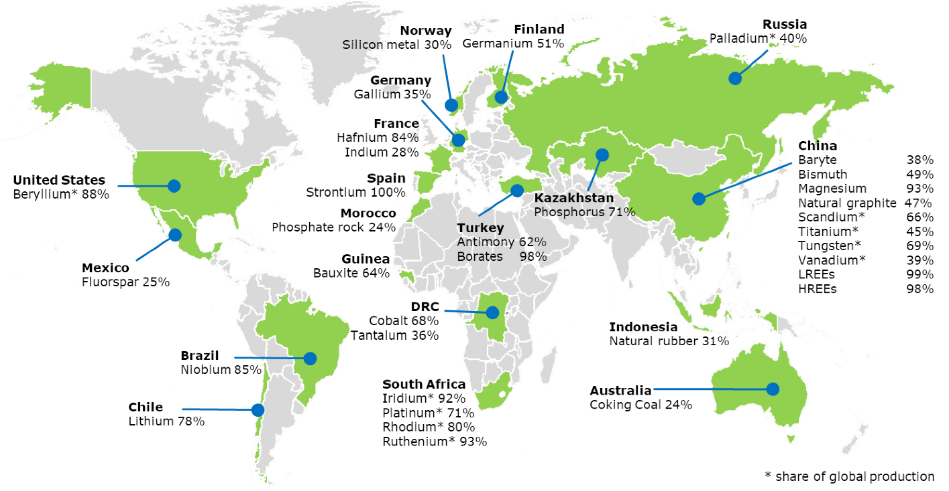

In 2020, the European Commission recorded the most important raw materials for Europe’s economy and its climate neutral goals, and published a list of 30 Crucial Raw Materials. Among these there are materials like lithium and cobalt, present in all rechargeable batteries, or indium, which is the material used in touch screens. To identify and determine CRMs criticality, the Commission set two parameters: economic importance and supply risk. The 2020 “Study on the EU’s list of Critical Raw Materials” published by the European Commission defined economic importance as being “computed based on the importance of a given material for end-use applications and on the performance of its substitutes in these application.” Whereas, supply risk is based on the concentration of primary supply from raw materials producing countries, taking also into consideration their governance performance and trade aspects. This parameter is fundamental because it shows the specific risk of a disruption in the EU supply of the materials, being that EU’s industry and economy are dependent on the international markets to provide access to CRMs since they are produced and supplied by third countries.

EU’s dependency on external suppliers

“Two years after the start of the pandemic, we are again at a historic crossroads, for both Europe and the world, and our transatlantic alliance. (…) Several industries in the EU and around the world will face important setbacks, as Russia is an important exporter of a wide range of raw materials. The production of semiconductors, batteries, steel and other goods relies on supplies from Russia.”

Speech by European Commissioner Paolo Gentiloni, hosted by the University of Oxford

If there is one thing that the current energy crisis and its soaring prices highlighted, is that sourcing diversification, is one of the most efficient ways to move towards European “Strategic Autonomy”. However, as surprising as it may seem, sourcing diversification of CRMs is even more challenging than energy source diversification. The almost complete dependence on external suppliers for CRMs, puts Europe’s industry and ecological transition at high risk of disruption. The EU is dependent on foreign imports for more than 80% of its needed CRMs. CRMs imports became necessary for Europe, due to the limited knowledge of availability, absence of availability, and social and economic factors that negatively affect exploration. Nonotheless, the fact that China with a percentage just under 44%, is the largest supplier for the majority of CRMs used in the EU, and Russia being one of the biggest producers of palladium in the world, (indispensable for cleaning up car emissions), does not make the job easy for Europe. It is importat to note in the current situation, that Ukraine, besides Norway, has the biggest reserves of titanium in Europe (another essential material used across all industries). Furthermore, since July 2021, Ukraine signed with the EU, a Strategic Partnership on Raw Materials and became a member of the European Raw Materials Alliance (ERMA).

The EU’s action plan

In 2020, following the year of the global pandemic, the Von der Leyen Commission adopted a new EU industrial strategy, which represented a recognition of the change, that was necessary going to happen in the European society and economy, due to the ecological and digital transition that was enacted to define the Europe’s future. Part of the new industrial strategy is a series of measures that aim to increase the security and sustainability of CRMs supply. Moreover, on the 23rd of February 2022, the Commission published the Annual Single Market Report 2022 and the in-depth analysis of the Europe’s strategic dependencies, which set some fundamental milestones that the EU will work towards, to reach independency from CRMs external supply.

The first effective step that must be taken towards CRMs security of supply is certainly conducting research and exploration withing the EU territory. However, creating entire CRM value chains is lengthy and costly process, that begins in mines, which require large-scale, long-term investments projects, and can have serious environmental implications. Consequently, focusing on sustainable and responsible domestic sourcing and processing of CRMs is key.

As proven by the recent energy crisis, reaching sourcing diversification through commercial agreements with diverse countries is another step in the right direction. Nevertheless, supply of many critical raw materials is still, as other rare earths, highly concentrated and therefore complicated. To create new alliances with numerous partners, in October 2020 ERMA was established.

Another ERMA strategy of reducing external dependency of CRMs is through circular use of already existing resources. Expanding the EU Circular economy action plan, by recycling and retrieving CRMs from used products that are present in extractive waste or in landfills. In this way, CRMs can be recycled and injected back into the economy which represents a valid solution for aiming to the security of supply. To make this action possible, the EU must ensure that they can be traded easily across the EU and create a dynamic market for them.

In conclusion, by further developing a common EU policy on critical raw materials, the Commission is pursuing a strategic autonomy that would make Europe resilient, and more prepared to face unforeseen crises. Although it is a lengthy process CRMs are indispensable to ensure the goals set by Next Generation EU.